BTC Price Prediction: Analyzing Investment Potential Amid Technical Strength and Evolving Market Dynamics

#BTC

- Technical Strength: Bitcoin trading above key moving averages with strong volume support indicates underlying bullish momentum

- Institutional Landscape: Mixed signals from traditional finance integration are balanced by robust trading activity and continued advocacy

- Market Positioning: Current levels near upper Bollinger Band suggest potential for consolidation before next major move

BTC Price Prediction

Technical Analysis: Bitcoin Shows Bullish Momentum Above Key Moving Average

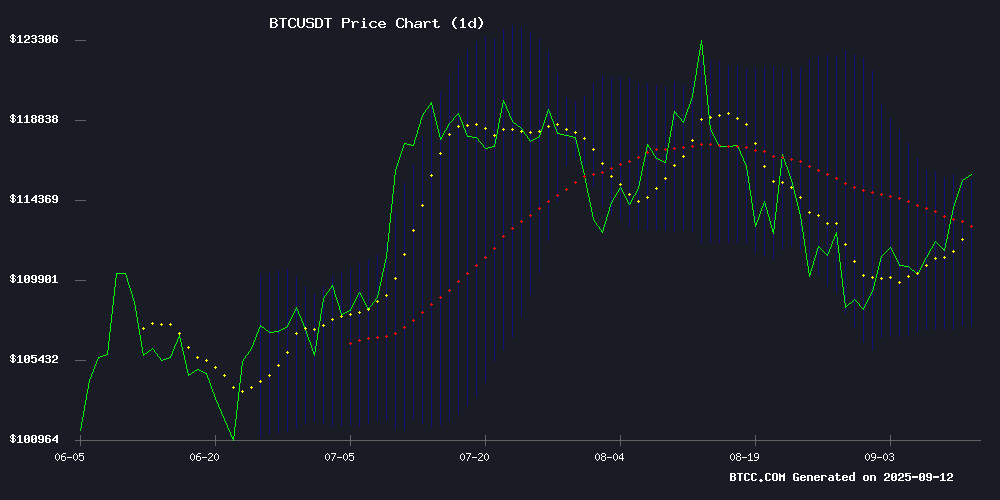

Bitcoin is currently trading at $115,728, positioned above its 20-day moving average of $111,416, indicating sustained bullish momentum. The MACD indicator shows a negative value of -39.86, suggesting some near-term consolidation, while the signal line at 1,825.52 and histogram at -1,865.38 reflect ongoing market adjustment. Bitcoin is trading near the upper Bollinger Band at $115,492, with the middle band at $111,416 and lower band at $107,340 providing support levels. According to BTCC financial analyst Robert, 'The price holding above the 20-day MA while approaching the upper Bollinger Band suggests continued strength, though traders should watch for potential resistance near current levels.'

Market Sentiment: Institutional Developments Create Mixed Signals

Market sentiment presents a complex picture as institutional adoption faces both setbacks and advancements. The S&P 500's rejection of MicroStrategy deals represents a temporary setback for corporate crypto treasury trends, yet bitcoin exchange volumes significantly outpacing ETF flows indicate robust retail and institutional participation. Korean traders reducing Bitcoin exposure as KOSPI hits records suggests regional profit-taking rather than broad market weakness. Michael Saylor's continued advocacy reinforces Bitcoin's narrative beyond mere asset classification. BTCC financial analyst Robert notes, 'While short-term headwinds exist from traditional finance integration challenges, the underlying volume and institutional interest patterns support medium-term bullish fundamentals.'

Factors Influencing BTC's Price

S&P 500's Rejection of MicroStrategy Deals Blow to Crypto Treasury Trend

JPMorgan analysts have framed the S&P 500 committee's exclusion of MicroStrategy as a watershed moment for corporate crypto adoption. The decision signals institutional skepticism toward companies leveraging balance sheets for Bitcoin accumulation, despite MicroStrategy meeting technical eligibility requirements.

The investment bank warns of Ripple effects across crypto treasury strategies, noting overcrowding as firms emulate MicroStrategy's playbook. Index providers may now reassess inclusion criteria for Bitcoin-heavy corporations, potentially cooling a trend that gained momentum during the 2021-2022 bull market.

"This isn't just about one company," analysts noted, highlighting how the discretionary rejection undermines the broader thesis of bitcoin as a mainstream treasury asset. The move coincides with declining institutional inflows into Bitcoin ETFs, suggesting macroeconomic headwinds for crypto adoption.

S&P 500 Hits Record High Amid Inflation Data; Crypto Stocks Outperform Bitcoin

The S&P 500 closed at a historic high of 6,587.47, while the Dow Jones surged 617 points to 46,108.00. The Nasdaq followed suit, climbing to 22,043.08. All three indexes achieved new intraday peaks, reflecting bullish sentiment despite mixed inflation figures. August's Consumer Price Index ROSE 0.4% monthly, exceeding the 0.3% forecast, while annual inflation held steady at 2.9%.

Crypto equities like Coinbase and Bit Digital outpaced Bitcoin's performance, continuing a trend observed since April. Wolfe Research notes Bitcoin's recent dominance over altcoins but questions its sustainability. The asset remains above $100,000—marking its longest stretch at this level—with ETFs drawing consistent inflows. Analysts suggest a potential climb to $115,000, though alternative trades may offer better short-term opportunities.

Bitcoin Exchange Volume Dwarfs ETF Flows Amid Market Volatility

Bitcoin's trading dynamics reveal a stark divide: centralized exchanges handle $15.8 billion in daily volume compared to just $1.7 billion for spot ETFs. This 10-to-1 ratio underscores how exchange-driven flows still dictate short-term price action, even as institutional products gain traction.

The NVT ratio's rise and weakening Stock-to-Flow model hint at correction risks despite robust exchange activity. Retail participation in futures remains subdued, leaving institutional traders to dominate liquidity—a double-edged sword that reduces speculative froth but amplifies the impact of large repositioning.

Korean Traders Retreat from Bitcoin as KOSPI Hits Record High

Bitcoin's modest 1.43% gain to $113,890 contrasts with the KOSPI Composite Index's surge to an all-time high, echoing a 2021 pattern where both assets peaked in tandem. Korean investors are reducing BTC exposure despite ongoing accumulation, as measured by the Korean Premium Index.

The KOSPI's strength—last seen during Bitcoin's historic 2021 rally—suggests a potential inflection point. Alphractal data indicates this correlation could foreshadow a BTC price ceiling before downward movement, mirroring previous market cycles.

Michael Saylor Says Bitcoin Is Not Just An Asset; What Is It Then?

Bitcoin has evolved beyond a mere asset, now widely regarded as digital gold. Michael Saylor, executive chairman of MicroStrategy, emphasized its role in driving prosperity and freedom during a CNBC interview. He framed Bitcoin adoption as a strategic imperative for individuals, businesses, and governments in the digital age.

The accelerating institutional adoption of BTC creates a Pro Rata effect, Saylor noted. When major holders exit, their coins are effectively burned, redistributing value to remaining stakeholders based on contribution. This dynamic reinforces Bitcoin's scarcity and network resilience.

Bitcoin Faces Critical Juncture as Analysts Debate Next Move

Bitcoin's recent surge above $114,000 has sparked both Optimism and caution among market observers. The 4% weekly gain masks underlying fragility, with Alphractal founder Joao Wedson warning of potential downside risks. Key resistance at $116,000 remains the litmus test for sustained bullish momentum.

Technical analysis suggests $110,400 represents crucial support, with a breach potentially triggering a slide toward $105,000. Wedson emphasizes the need for confirming signals—including Bitcoin dominance patterns, improved buy/sell pressure metrics, and on-chain reversal trends—before declaring a definitive trend.

TFT AI's 30-day forecast echoes this cautious stance, projecting neutral trading between $108,000-$120,000 with heightened volatility expected in late September. Short-term models anticipate minor retracement, leaving traders weighing whether current levels represent consolidation before breakout or distribution before correction.

QMMM Holdings Stock Surges 1,070% on Crypto Pivot Before Partial Retreat

QMMM Holdings, a Hong Kong-based digital media company, saw its stock skyrocket by as much as 3,816% this week after announcing a strategic shift into cryptocurrency. The firm, which operates subsidiaries Quantum Matrix and ManyMany Creations, plans to allocate $100 million to Bitcoin (BTC) and other digital assets while developing a blockchain-based media platform.

The rally peaked on Tuesday before retreating to a 1,070% gain by mid-week. This mirrors 2016's trend where distressed companies temporarily boosted valuations through crypto-related announcements. QMMM had previously faced delisting risks due to depressed share prices.

Market observers note the volatility highlights speculative fervor surrounding crypto pivots, particularly among financially challenged firms. The company's debt-financed crypto acquisition strategy raises questions about sustainability beyond the initial hype cycle.

Is BTC a good investment?

Based on current technical indicators and market developments, Bitcoin demonstrates strong investment characteristics for risk-tolerant investors. The price trading above key moving averages combined with substantial exchange volume suggests healthy market participation. However, investors should consider the following factors:

| Factor | Assessment | Impact |

|---|---|---|

| Technical Position | Above 20-day MA ($111,416) | Bullish |

| Bollinger Band Position | Near upper band ($115,492) | Neutral-to-Bullish |

| MACD Signal | Negative but improving | Short-term Caution |

| Institutional Adoption | Mixed signals | Medium-term Positive |

| Trading Volume | Strong relative to ETFs | Very Bullish |

BTCC financial analyst Robert concludes: 'Bitcoin remains a compelling investment for those with appropriate risk tolerance, though current levels warrant careful position sizing given proximity to technical resistance.'